Top 10 Things to Learn About Financial Scandals

Financial scandals have been making headlines over the last decade, and now they are on public display in Lower Manhattan. The Museum of American Finance’s exhibit, Scandal! Financial Crime, Chicanery and Corruption that Rocked America, and its associated walking tour, are exposing more than two centuries’ worth of white-collar crime to Wall Street visitors. Below are some of the little-known facts about financial scandals, compiled by the Museum’s Deputy Director, Kristin Aguilera.

10. The country’s first financial scandal occurred in 1792. The perpetrator, William Duer, was a former member of the US Treasury Department under Alexander Hamilton.

9. In response to the first financial scandal, the New York State Legislature enacted a law against public trading, which led to the creation of the private association of traders in 1792 that eventually became the New York Stock Exchange.

8. Secretary of the Interior Albert Fall, who served during the Harding Administration, holds the dubious distinction of being the first member of a presidential cabinet to be sent to prison as a result of his actions in office. He was convicted of accepting bribes in return for drilling rights on government oil reserves in the Teapot Dome Scandal.

7. The Credit Mobilier Scandal involved 15 congressmen, six senators and Vice President of the US Schuyler Colfax, and was a betrayal of the public trust of epic proportions: These men profited from a company that was egregiously overcharging the government to build a cross-country railroad.

6. The Salad Oil Scandal, one of the largest financial swindles of all time, remains largely unknown because the story broke just a few days before President Kennedy was killed and was overshadowed by news of the assassination.

5. By 2001, Fortune magazine had named Enron “America’s most innovative company” six years in a row. When Enron collapsed later that year, it became the largest bankruptcy in US history.

4. Financial scandals have spurred dozens of reforms to ensure that similar events never recur. In recent history, the Sarbanes-Oxley Act was enacted in response to a slew of accounting scandals that made headlines and rocked the markets between 2000-2002.

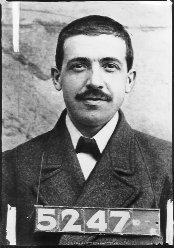

3. Ponzi schemes are named after Charles Ponzi, who coaxed approximately $7 million from investors in the 1920s, promising a 50 percent return in 45 days through a scheme that purportedly involved arbitrage of postal reply coupons.

2. As is the case with most financial scandals, Ponzi schemes are not sustainable in the long run. And as Bernie Madoff would attest, perpetrators always get caught.

1. As Mark Twain reportedly said, history doesn’t repeat itself, but it does rhyme. Modern-day financial scandals contain many of the same elements as the scandals of the 18th century.

Scandal! Financial Crime, Chicanery and Corruption that Rocked America will be on display at the Museum of American Finance (48 Wall Street) through April 2011. The next Wall Street Scandals walking tour will be held on Saturday, August 14, at 1 PM. For more information, visit www.moaf.org or call 212-908-4110.