Q3 Leasing Returns to Post-Pandemic Levels in Lower Manhattan Office Market

The third quarter of Lower Manhattan office leasing settled back to post-pandemic levels. Leasing activity returned to trends seen over the last several years after the neighborhood experienced an inflated level of activity in the second quarter, primarily due to a single large lease for a government agency. In addition, vacancy rates fell, but remained stubbornly high. This mirrors ongoing trends experienced across Manhattan submarkets as the office market continues to face macroeconomic headwinds. Meanwhile, the retail and hospitality markets continued to show positive signs, according to the Alliance for Downtown New York’s Q3 2023 Lower Manhattan Real Estate Report.

Lower Manhattan recorded 620,066 square feet of new leasing in the third quarter, which marked a decline from the previous quarter’s activity, but a 20% increase from the first quarter of the year. The two largest leases of the quarter included a 183,255 square-foot renewal for the Department of Citywide Administrative Services at 255 Greenwich Street and a 121,904 square-foot relocation from Midtown South to 120 Broadway for Tower Research Capital. The overall vacancy rate fell slightly to 23.9%, but is still up 0.9% year-over-year.

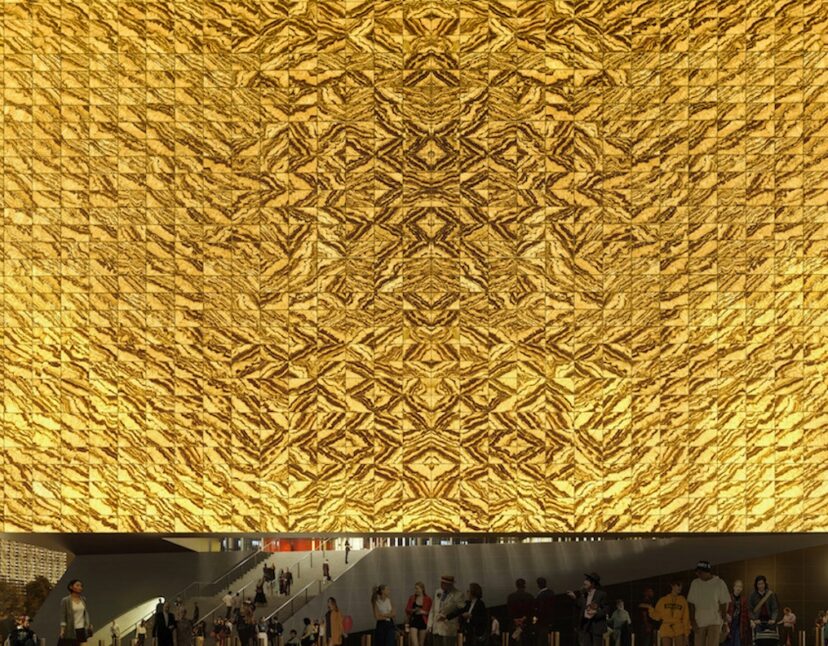

“While the office market in Lower Manhattan remains sluggish, the neighborhood has been injected with a fresh sense of energy this fall with the opening of the Ronald O. Perelman Performing Arts Center (PAC NYC) ,” said Jessica Lappin, President, Alliance for Downtown New York. “This spectacular new venue is the latest in an increasingly broad array of entertainment options now found downtown. As well, the tourism and hospitality sectors continue to show strength, with our hotel occupancy levels nearly matching rates from just prior to the pandemic.”

In September, the long awaited PAC NYC opened at the World Trade Center Campus. PAC NYC joins a growing list of first-class entertainment venues in Lower Manhattan, including the concert venue Pier 17 and the immersive art exhibit Hall des Lumières at 49 Chambers St. Cinema options in the neighborhood have also expanded in recent years and include Alamo Drafthouse as well as IPIC Fulton.

On the retail front, Lower Manhattan saw 12 new openings in Q3, many of which are food and beverage businesses. This included the reopening of Delmonico’s, the famous steakhouse located at 56 Beaver St. that had been closed since the beginning of the pandemic. Also of note, several Asian restaurants opened up, including Dim Sum Palace at 123 William St., ImmThai at 80 Nassau St. and Tsubame at 11 Park Pl. Looking forward, eight retailers announced plans in Q3 to open locations in Lower Manhattan.

Meanwhile, hotel and tourism numbers continue to rebound. Lower Manhattan saw hotel occupancy rate reach 83% in Q3, nearly reaching parity with pre-pandemic levels. Occupancy growth for Lower Manhattan hotels outpaced the citywide average, which rose by 7% year over year. Daily room rates were 60% higher in Lower Manhattan compared to the citywide average — $300 to $188. The current hotel inventory in Lower Manhattan stands at 9,087 rooms across 43 hotels. There are over 940 rooms across five hotels under construction or under development, including the Warren Street Hotel, a boutique hotel expected to open in early 2024 at 86 Warren St.

For more info, including the full Q3 2023 Lower Manhattan Real Estate Report, CLICK HERE