Lower Manhattan Real Estate Overview, Q3 2023

The Alliance for Downtown New York’s third quarter report provides data on commercial office, retail, residential, hospitality and development projects. Major findings include:

Leasing Activity Settles Back to Post-pandemic Levels as Availability Remains High

The third quarter saw leasing activity in Lower Manhattan return to post-pandemic levels, with 620,066 sq. ft. of leasing — which was higher than the first quarter of 2023. Leasing was mainly driven by NYC Department of Citywide Administrative Services as well as by Tower Research Capital, who inked a 183,255 sq. ft. and a 121,904 sq. ft. deal, respectively.

Median Apartment Rents Grow Across Downtown and Manhattan

The median rent in Lower Manhattan rose to $4,768, up 6% from the beginning of the year. Median rents are now nearly 20% higher than before the pandemic. Manhattan’s overall median rent rose to a new record high of $4,399, marking the seventh consecutive quarter above pre-pandemic rates amid high demand, tight supply, and competition from would-be homebuyers remaining in the rental market due to increased interest rates.

New Retail Openings Expand Lower Manhattan’s Shopping, Dining and Entertainment Offerings

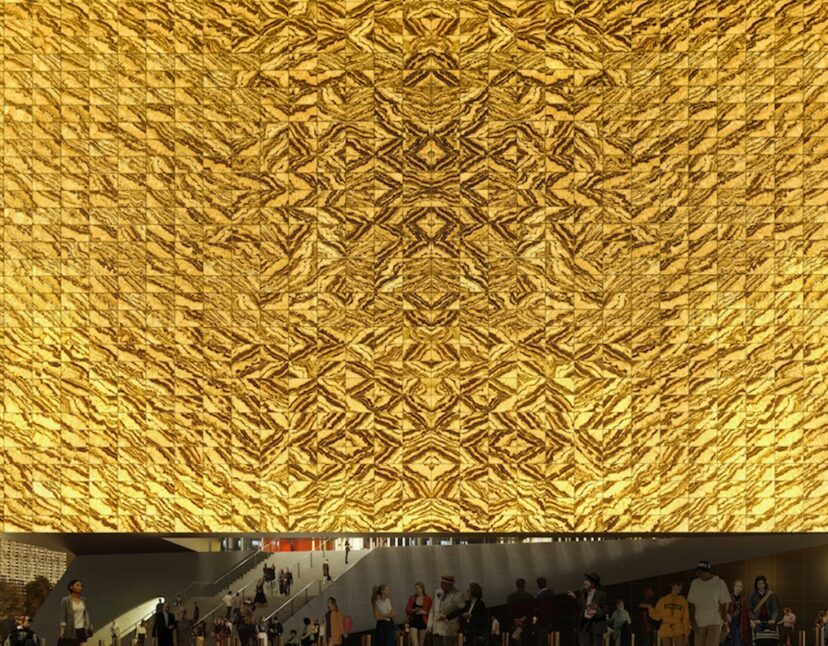

Entertainment got the largest boost this quarter, as the Ronald O. Perelman Performing Arts Center (PAC NYC) opened its doors to theatergoers. A number of sit-down and casual restaurants also debuted in Lower Manhattan, including Delmonico’s, a famous steakhouse that closed during the pandemic. AbcV, a Jean-George Vongretchen vegetarian restaurant, recently opened at the Tin Building, replacing Seeds + Weeds. In addition to dining, Arcteryx, an outdoor apparel company, opened at Brookfield Place.

Tourism Picks Up as Hotel Occupancy and Room Rates Continue Recovery

Hotel occupancy rebounded sharply from the previous quarter across Manhattan hotel markets. At 83%, occupancy nearly rose to parity with pre-pandemic levels citywide and in Lower Manhattan. Hotel occupancy in Lower Manhattan was 9% higher than in the second quarter. Occupancy growth for Lower Manhattan hotels outpaced the citywide average, which rose by 7% year over year. And daily room rates were 60% higher in Lower Manhattan compared to the citywide average — $300 to $188.